Are you confident that you can cover the cost of life-saving care for your cat? If the answer isn’t a resounding “Yes”, you may want to consider pet insurance.

The best pet insurance could save you thousands of dollars over the course of your cat’s life, giving you both peace of mind and a happier wallet. On the other hand, the wrong wrong pet insurance can be both a headache and a drain on your finances. So how do you choose the right pet insurance provider?

In this article, you’ll learn about the factors that make pet insurance a worthwhile investment and what fine print points you won’t want to gloss over. You’ll also find in-depth reviews of our recommendations for the best pet insurance you can buy for your cat.

At a Glance: Top 10 Pet Insurance Providers Reviewed and Compared

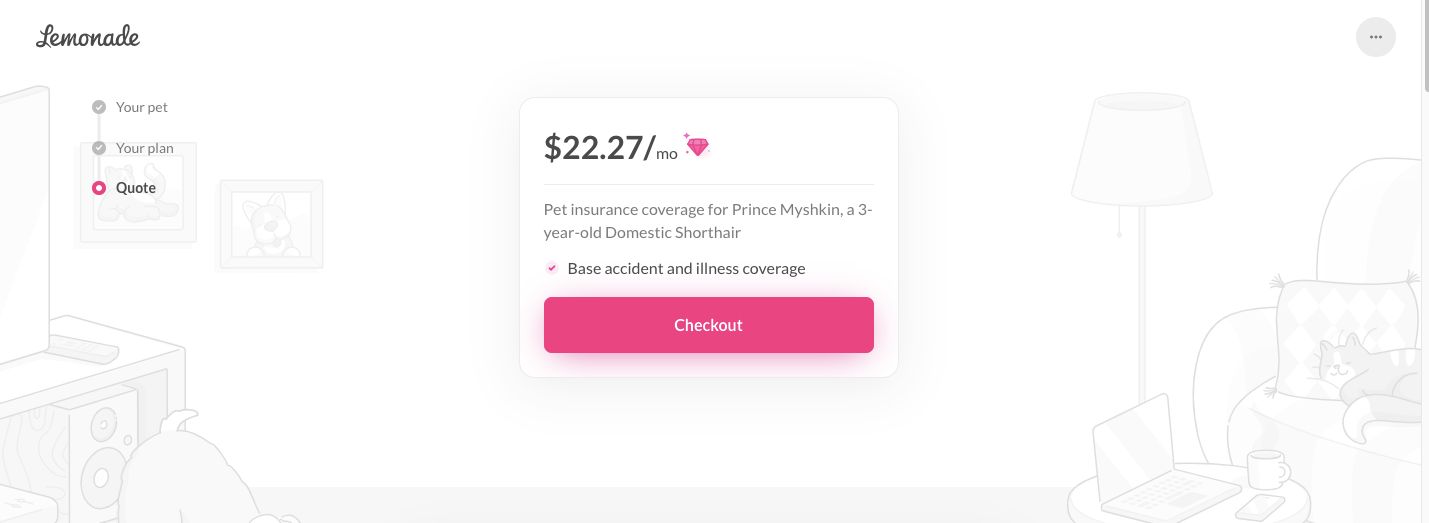

Lemonade Pet Insurance

- Insure your pet in seconds starting as low as $10/month

- Flexible deductibles, reimbursement rate, and annual limit

- Optional coverage for routine care, and wellness visits

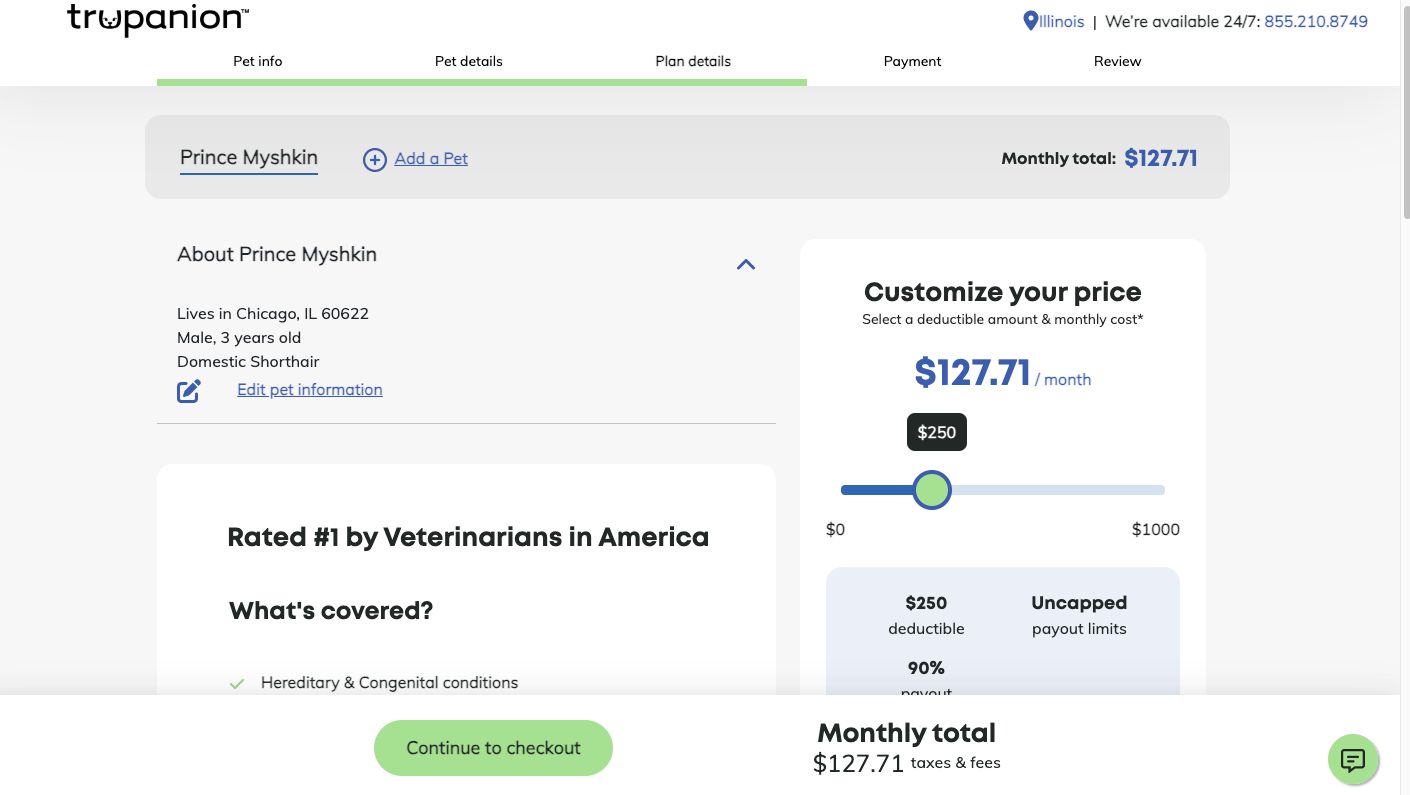

Trupanion Pet Insurance

- 90% reimbursement and unlimited payout limits- always

- Customizable deductibles from $0-$1,000, in $5 increments

- The only company that can pay your veterinarian directly, within seconds, at checkout

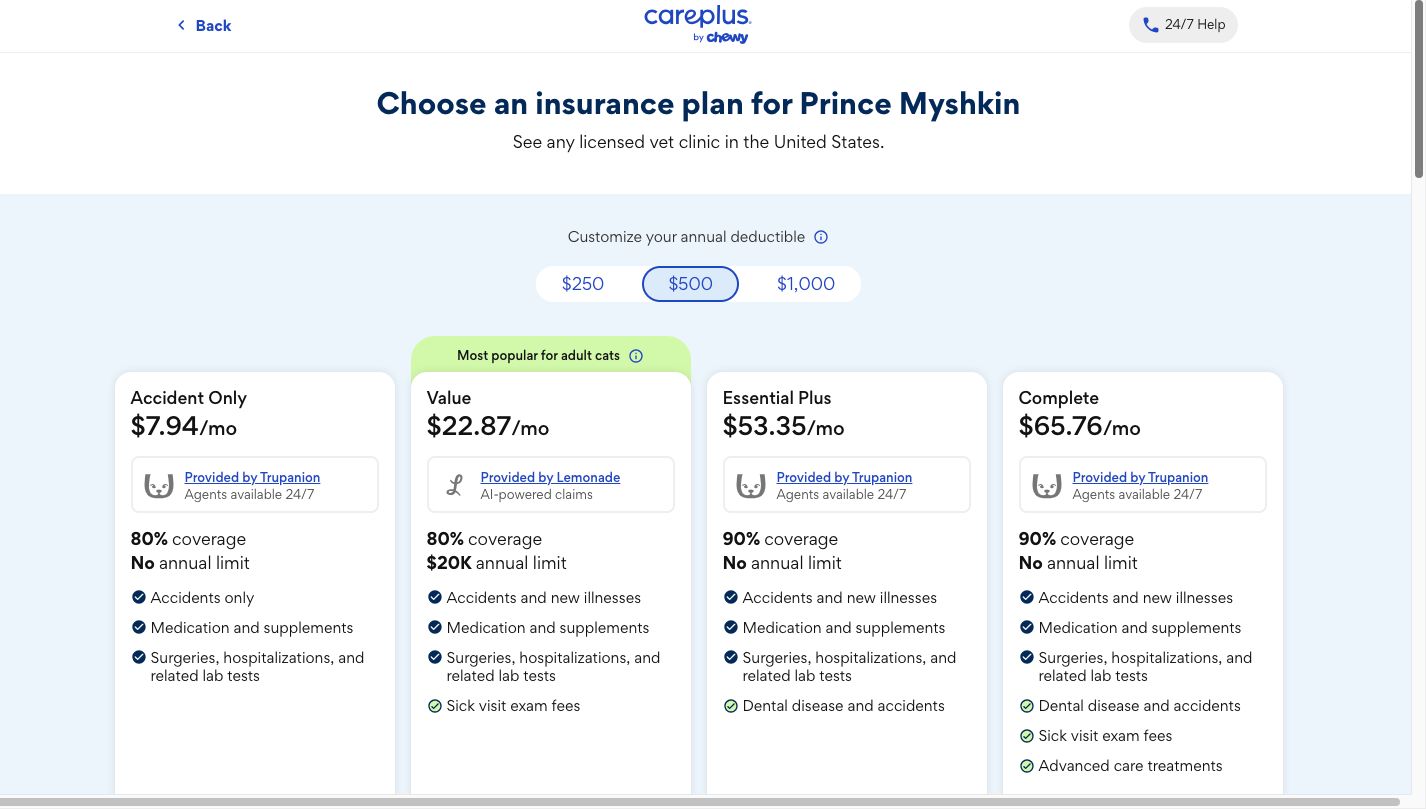

CarePlus Pet Insurance

- Accident-only, comprehensive, and wellness plans available

- Up to 100% reimbursement for prescriptions and supplements

- Free and unlimited access to Chewy's Connect with a Vet program

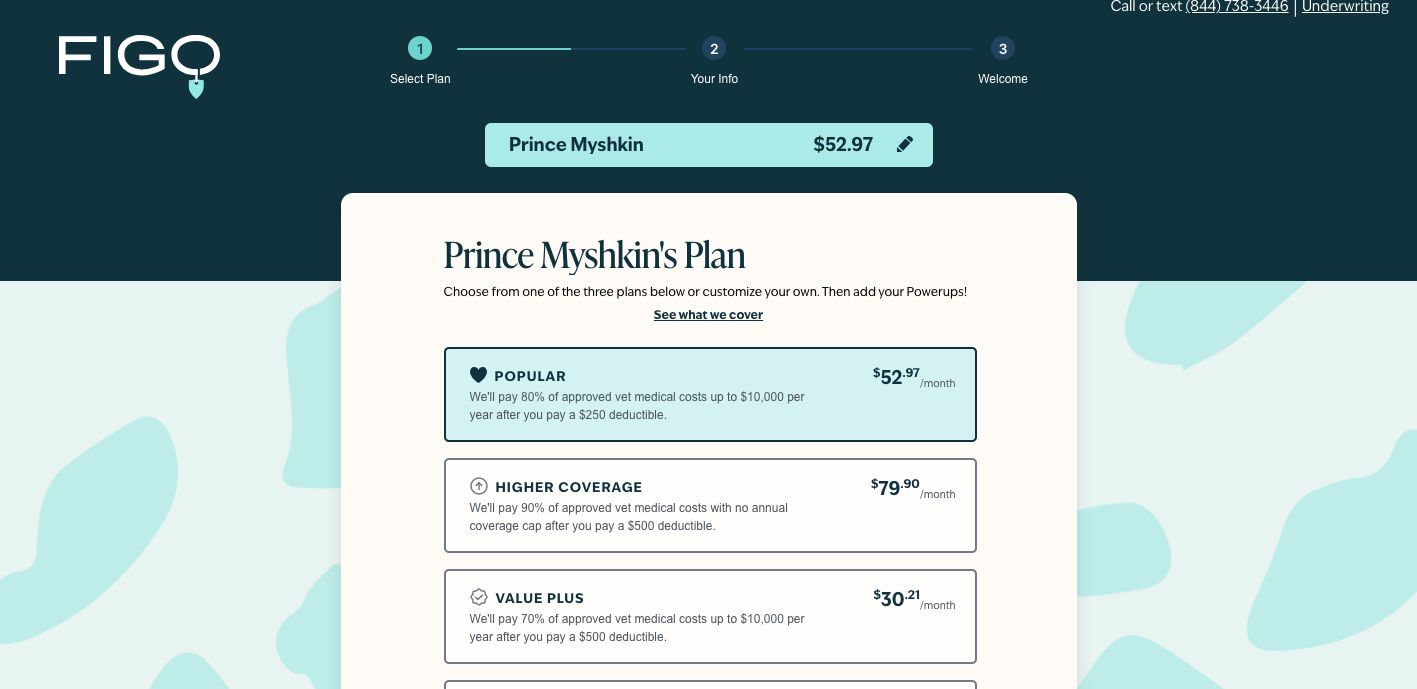

Figo Pet Insurance

- Offers annual coverage limits of $5,000, $10,000, and unlimited

- Choose an annual deductible of between $100 and $1,500 (reduced by $50 every claim-free year)

- Choose a reimbursement level of 70%, 80%, 90%, or 100%

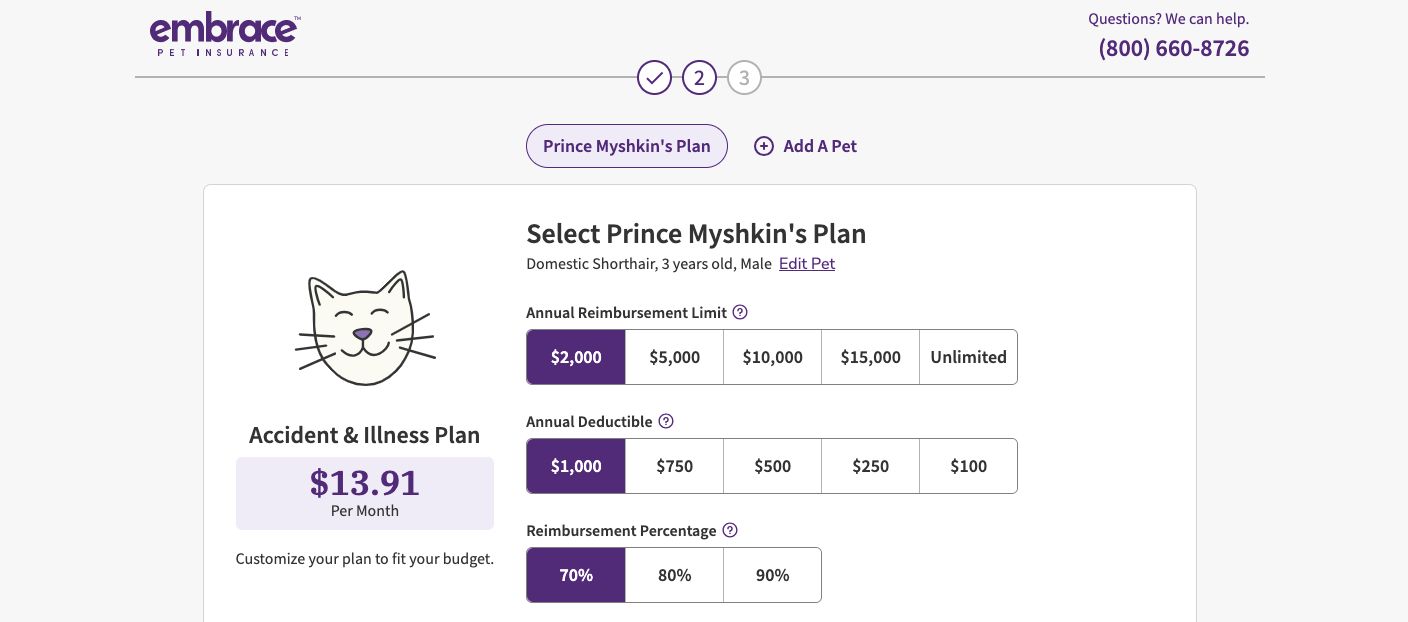

Embrace Pet Insurance

- Flexible deductible between $100 and $1000

- Annual payout maximum between $2,000 and $15,000 or Unlimited

- Choose a reimbursement percentage of 70%, 80%, or 90%

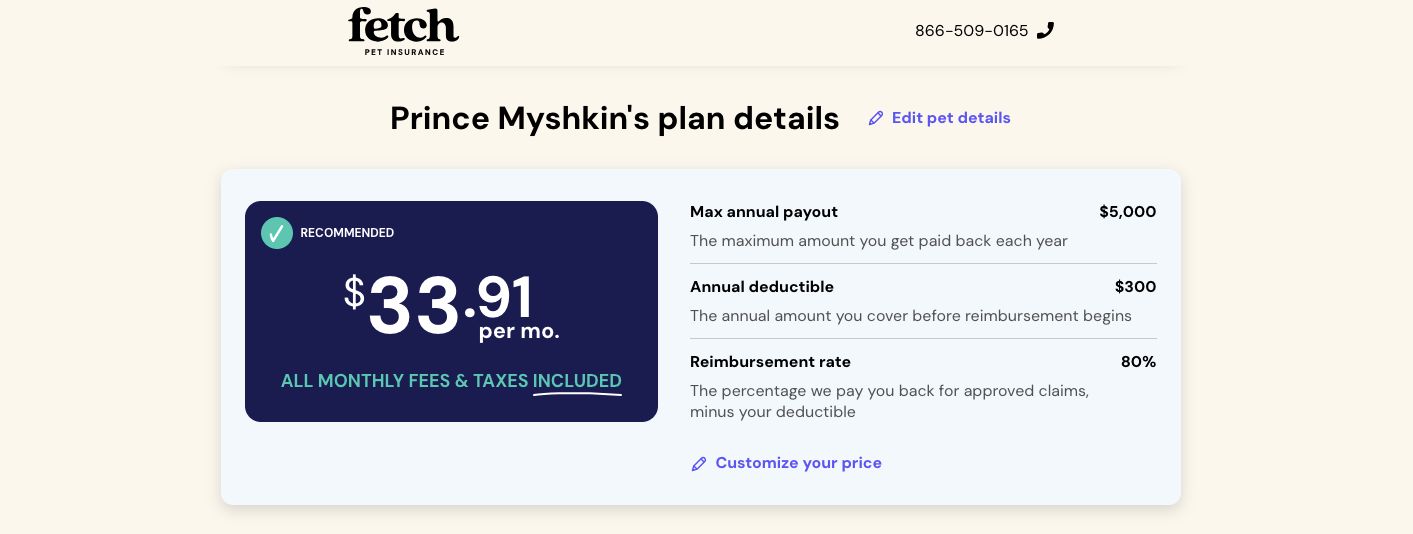

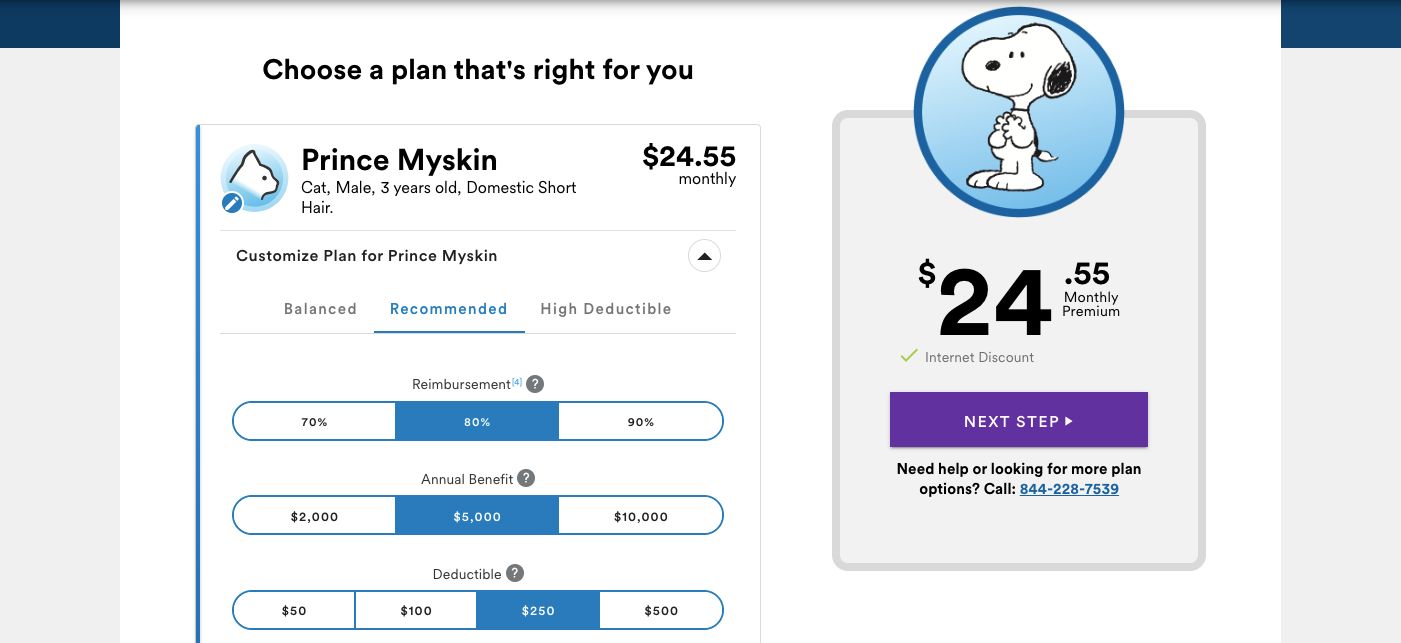

Fetch Pet Insurance

- Choice of annual coverage amount – $5,000 to 15,000

- Choice of annual deductible amount – $250 to $400

- You can choose your reimbursement percentage – 70%, 80%, or 90%

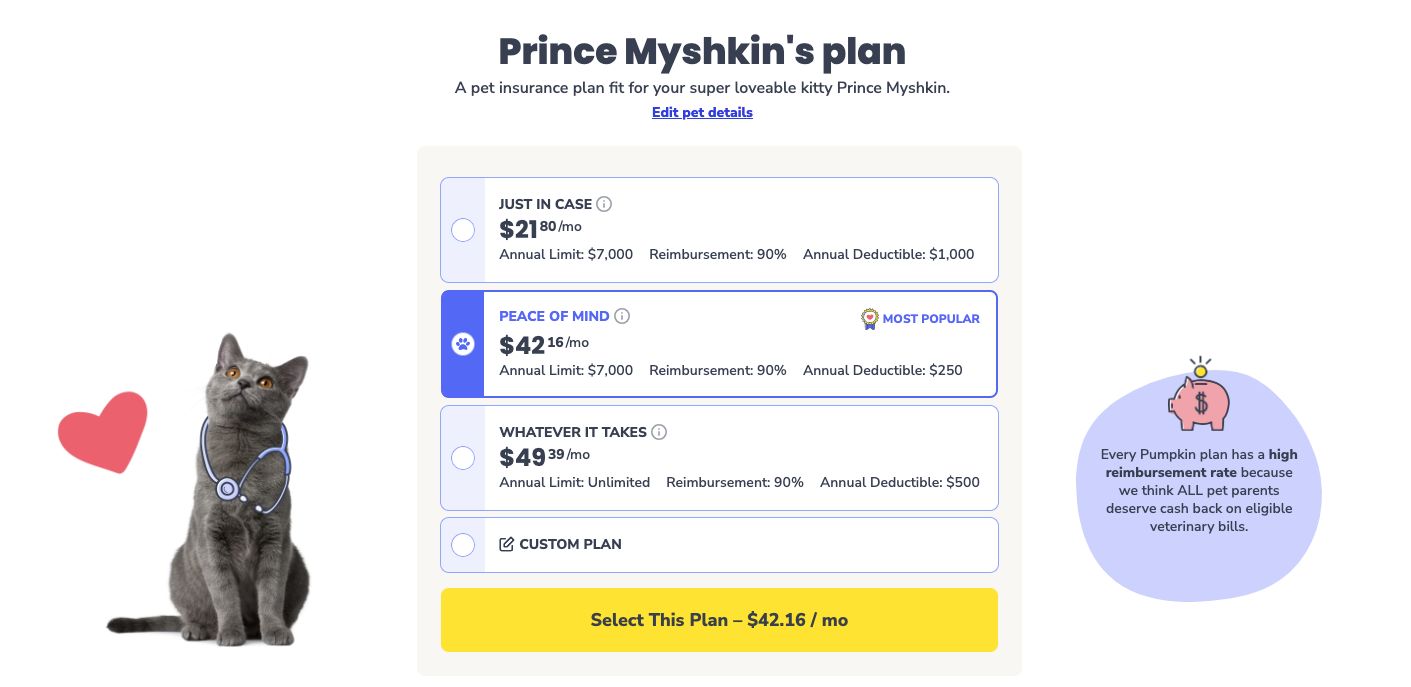

Pumpkin Pet Insurance

- Offers extensive coverage for many services

- Accepts cats of any age 8 weeks or older

- Easy signup process

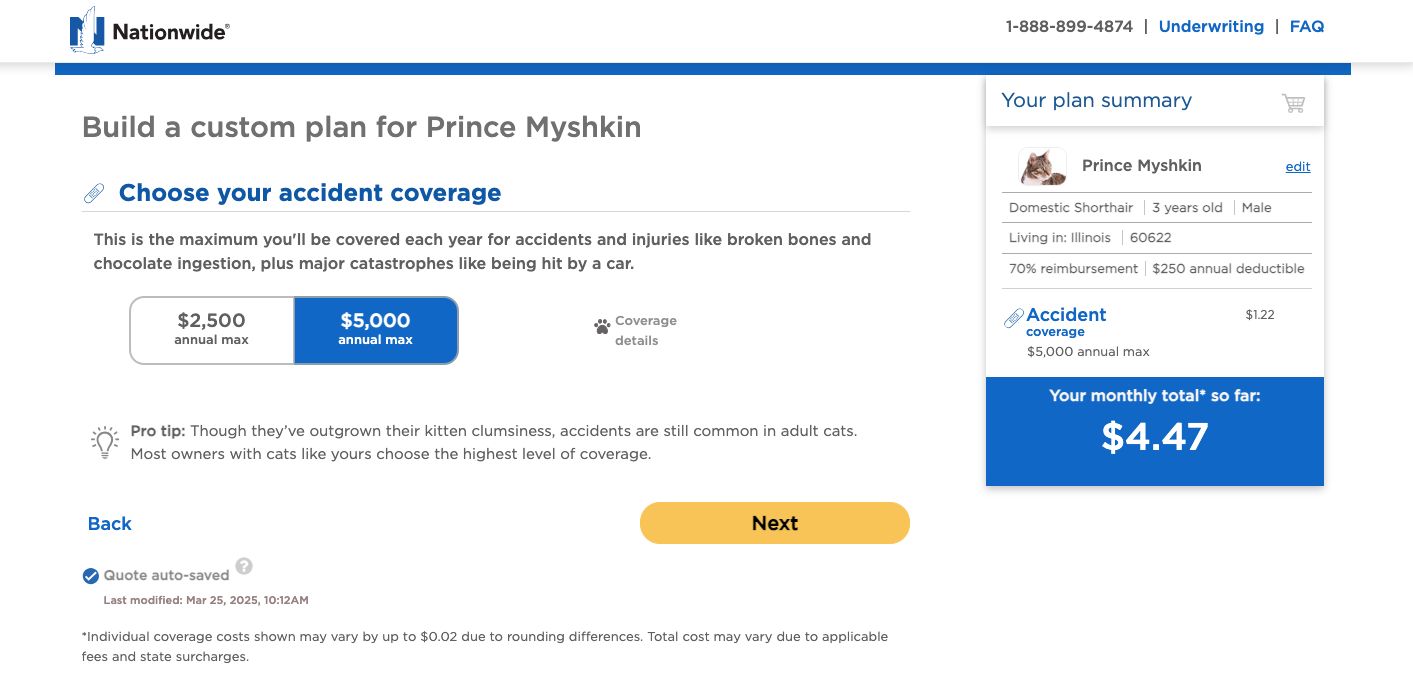

Nationwide Pet Insurance

- Choice of annual deductible amount – $250 to $1,000

- You can choose your reimbursement percentage – 50%, 70%, or 80%

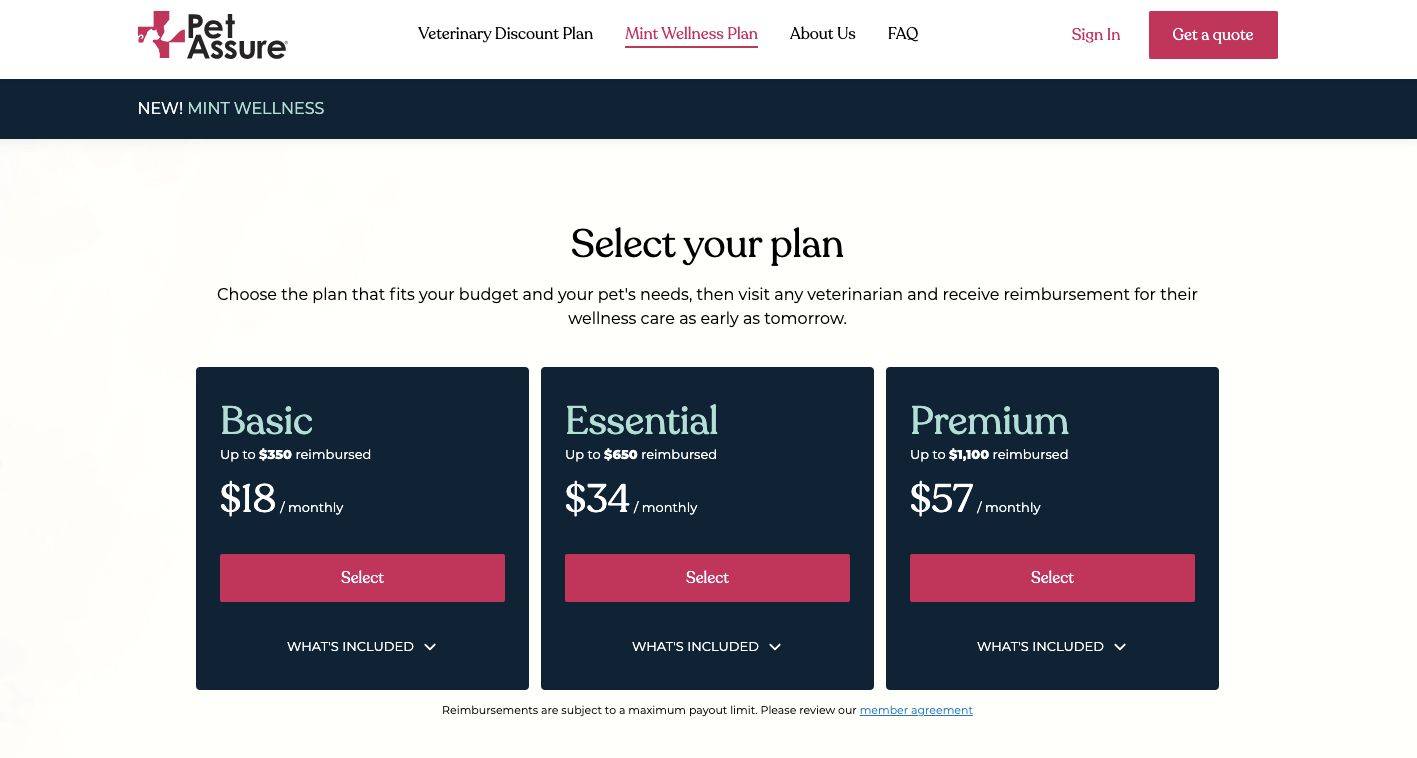

Pet Assure

- Doesn’t exclude any pets, regardless of age or health history

- Comes with a 24/7 lost pet recovery service

- All medical procedures and in-house veterinary services are covered

Metlife Pet Insurance

- Flexible premiums based on deductibles and limits

- Emergency exam fees are covered

- Optional preventive care coverage in Standard Wellness add-on

Why Trust Cats.com

With three cats to care for, I spend more than I’d like to admit on vet visits. As my cats get older, however, I start to worry that a sudden illness or an injury might require emergency care and expensive treatments. To determine whether pet insurance might be a good option for my own cats, I’ve spent countless hours scouring the market to learn how pet insurance works and what providers are the most trustworthy.

To create this guide, I gathered over 25 quotes and went in-depth to research the top pet insurance providers on the market, evaluating rates, policies, and customer service. I also talked with several veterinarians, insurance customers, and others to learn about their experience with and opinions on insurance for cats. Finally, I scoured review sites, reading hundreds of customer reviews to get a feel for what it’s like to be a customer for each of the providers listed below.

Our Veterinary Advisors

Top Picks Explained

Pet insurance is a rapidly changing industry, so our recommendations change with the times. While this video doesn’t include all of our top picks, you may find it helpful in narrowing down your options.

The Best Pet Insurance for Cats: Our Top 10 Picks

There is no one-size-fits-all in pet insurance. Choosing the best insurance policy for your cat requires cultivating an understanding of the pet insurance business and doing a little self-reflection about your unique needs.

To compare costs, we’ve requested quotes from each company using the same fictional cat profile: a neutered 3-year-old domestic shorthair living in Chicago, Illinois. His name is Prince Myshkin and he’ll be helping us compare the rates offered by the 9 insurance providers on this list.

Is Cat Insurance Worth It? What Reddit Users Have to Say

Everyone’s situation is unique, so cat insurance may be more appropriate for some cat owners than others. The decision is entirely up to you, but it may help you make your decision to hear what some real users have to say about some of the pet insurance companies on this list.

Lemonade Customer Review: “The most bang for your buck.”

“I did a lot of digging beforehand and Lemonade was in the top 3 of every top 10 list I looked at and it was consistently the most bang for your buck (ie: Yeah, I could have insured him for $8 a month but it was with a $2k deductible). I live in NY where vets are a bit pricey which is why my base charge was $18 a month but the national average was $14.

I also picked the midrange insurance. I could have paid less and got a $500 deductible or more with a $0 deductible.” – Reddit user u/quitmybellyachin

Embrace Customer Review: “The coverage is easy to understand.”

“I have Embrace now and I’m very pleased with them. The coverage is easy to understand and I haven’t had trouble getting straight answers from anyone on the occasions that I’ve called to ask questions…

They’ve paid out about $1500 without a whimper in my first year, so coverage is already well worth it. I just got my renewal notice, this year’s policy is about $60 higher than last year’s which is a typical increase based on other companies I’ve had in the past.” – Reddit user u/chernaboggles

Fetch Customer Review: “I get reimbursed directly into my account.”

“I’ve had both fetch and trupanion through work. My Fetch plan is much better. The $250 deductible is yearly, vs per issue; the coverage is higher (90% vs 80%) and unlike Trupanion they cover exam fees which is HUGE (my vet charges 150 per exam, and those can really stack up if your pet gets a long running ear infection etc).

My gripe with Fetch is that they request so many medical records. Every time you submit a claim you need new medical records and sometimes they request other completely random documentation. So it takes forever going back and forth with my vet and them, and you kind of have to babysit your claim. You can expect to pay a lot out of pocket and not see money for months.

I get reimbursed directly into my bank account – no paper checks. For me, Trupanion didn’t pay on the spot, I also had to submit claims. However Trupanion was much quicker about approving them with no back and forth or hassle. That was pretty much the only advantage about them.” – Reddit user u/bedlingtonmom

Trupanion Customer Review: “They can pay some vets directly.”

“I LOVE Trupanion. They come highly recommended by vets. They can pay some vets directly so I don’t have to wait to be reimbursed. (Their website has a list of direct pay vets). I did not care for the idea of a per condition deductible, so I chose to get a zero deductible policy. Once you choose your deductible with Trupanion, you can never lower it, but you can raise it later if you want.” – Reddit user u/Tamsin72

Nationwide Customer Review: “I have saved a ton of money.”

“I am not a vet, but I have had a good experience with nationwide. I do not have the wellness plan, I have a plan from my employer but it basically equates to their major medical coverage. Vets don’t choose to cover/not cover- it works differently than your insurance. You pay your vet the same as usual and submit insurance claims after the fact. I have saved a ton of money using nationwide.” – Reddit user u/shellymiscavige

Also Read:

Frequently Asked Questions

Is it worth getting pet insurance for a cat?

Pet insurance can provide cat owners with a safety net against unexpected costs, but it doesn’t always end up being an economic choice. If your pet is young and healthy, the cost of monthly premiums may be unnecessary. For cats prone to serious health issues, however, it can be beneficial as long as your cat’s condition isn’t considered a pre-existing condition.

What is not covered by pet insurance?

No pet insurance plan covers pre-existing conditions which is generally defined as a condition your cat has shown signs of, been diagnosed with, or treated for prior to the plan’s effective date. Many plans also don’t cover routine vet visits or wellness costs.

Does pet insurance cover routine visits?

Most plans don’t, though some pet insurance companies offer separate coverage for routine wellness. Optional insurance coverage may be available for preventive care and alternative therapies such as acupuncture and chiropractic care.

What's the best pet insurance for cats

Though Lemonade is our top pick, there’s no one-size-fits-all in pet insurance. Choosing the best insurance policy for your cat requires cultivating an understanding of the pet insurance business and doing a little self-reflection about your unique needs

For the examples above it would be great to see an out of pocket expense for each plan. Yes, you’d have to presume expenses like an annual wellness exam, a dental cleaning, vaccines and perhaps an emergency situation like if the cat ate a pointsetta. I’m learning that some plans reimburse your actual cost (pumpkin) while others reimburse based on a market average they determine (e.g. ASPCA). It’s hard to dig this information out of the pet plan materials.

Hi! My two cats are fairly healthy BUT… they both have “incidental findings” when they were being seen for something else. One hip dysplasia with no symptoms and mild HCM. The other has mild HCM and has had dental issues. Both have had gingivitis and one has had a few teeth pulled. So it is my understanding that nothing related to hip dysplasia even though there’s no symptoms, heart disease even though there’s no symptoms, and dental cleanings… None of this would be covered? And what about the vet documenting that the cat has food sensitivities and gets diarrhea with certain foods? Does that mean anything related to the G.I. track would not be covered? I called Lemonade and they told me nothing above would be covered bc it’s pre-existing even without symptoms. So should I bother to pay $35 a month? Also the dental cleaning only pays back 80% of $150? My vet charges almost one thousand for dental cleanings…so that’s not worth much. IMO. I’d love anyone to tell me I’m missing something? Thanks!

Based on what Lemonade told you, it sounds like none of the pre-existing conditions—including hip dysplasia, HCM, and GI issues—would be covered, even if they aren’t currently causing symptoms. If their dental coverage only reimburses 80% of $150, that wouldn’t make much of a dent in a $1,000 cleaning bill. Given the exclusions and limited dental benefits, it may not be worth the $35/month unless you want coverage for unexpected future illnesses or injuries.

I’m surprised you didn’t include Pets Best in your latest reviews. They have high ratings across all review platforms as well as a A+ rating with the Better Business Bureau. Costs are comparable with the others with more included.

SAD! But most Veterinarians and Vet Hospitals are at the mercy of the Investors now. So the investors design Wellness Programs and push us into having to front load Diagnostic costs to ensure they get their cut. If the investors weren’t running these Cash Cows of Business in Vet Care, then we might be able to afford our pets like we once could. Horrible what’s happened to the Vet Care sector. There are lots of articles available about how investors are doing this. They are depending on our emotions over our pets so they get their money. Insurance is how we stomach it. Awful and predatory.

I was seriously interested in Lemonade insurance for my cat and filled out the information requested to get a quote/check prices, etc. but then I was told it’s not in our area/state. I am seriously disappointed about that.

What I’m looking for is a pet insurance that covers or has as an “extra” fee, dental insurance, especially for yearly cleaning and for of course dental surgery. Wading through all the companies has been terribly confusing. I currently have Pumpkin, but am looking to replace that coverage. When I submitted the estimated cost of dental surgery (needing one or possibly two teeth pulled due to resorption), it was denied with the reason it is/was a “pre existing condition”. Baloney. I’ve been with Pumpkin for over two years and the possibility of resorption was never mentioned by my vet. It was not pre existing. Now I don’t know which company to go to.

Hi Kathi,

Did you try Figo or Embrace? I’d send them the current plan you have and ask if they can do better

Try Best for Pets in New Zealand.

What’re your thoughts on Spot? I’ve been seeing lots of ads regarding them recently and wanted some more insight if possible

I would not advise every relying on a web site from any insurer. Call them. Lemonade’s off-shore call center could not describe what a pre-existing condition might be in terms of dental. Gingivitis? Periodontal disease? (We don’t have a list of this, the agent said.) They said they could not point to any specifics on the website or documents. That means you wil be at their mercy when it comes time to putting in a claim. Pass.

Good advice, Suzanne. Many insurers don’t offer lists of what conditions are considered pre-existing because it varies depending on the cat. Usually, it’s anything the cat has been treated for (or shown symptoms of) prior to enrollment.

So from what these people are saying is your information is not accurate did you check all pet insurance did you really do your digging this says personal experience

While we did not open policies with all of these providers, we did research each one, read reviews from other customers, and gather quotes to get a sense for how all of them compared to one another. Each policyholder’s experience will be somewhat different, so the best we can do is try to piece things together from other user experiences and make inferences from there. Hope this helps!

Any rateing on Pets Are Us I believe this is the Costco Pet Insurance?

Hi Shirley! Thanks for the comment. Do you mean Pets Plus Us? Since this is an insurance provider selling policies only in Canada, we have not reviewed it here. However, you can see it reviewed in our article on the best insurance for cats in Canada.

Wow, I know when I first read about pet insurance a week ago, I was looking into it again. My previous 3 rescues had pet insurance, and it worked out wonderfully. Sadly they had passed at ages, 25, 24 and 22. After waiting a couple of years, I did take a rescue in again, he is 13 yrs young, was feral. (or abandoned) tried to purchase health insurance for him, first went to Lemonade because I found them outstanding, but was told they would not insure him. I have tired a couple of others and still no insurance. Doesn’t have any conditions nor illnesses , he’s taken to the vet every year, But the answers come back NO. So, on that note will keep up with appointments to the vet.

You may find that Figo is a better option for him—they don’t have any upper age limits. Hope everything works out well with this new kitty.

Just want to comment that Lemonade changed their policy and doesn’t have customizing options anymore. It’s a shame because my elder cat is on their previous policy and it has been amazing.

Thanks for the information. I had a kitty with diabetes and insurance would have been great. I also had another cat that didn’t get sick until the day before he passed at 21 years old. I now have a new cat and will take him to the vet in 2 weeks and then I will make my decision.

Yes, there’s so much variation in our cats and needs—there’s no way to predict exactly what each cat needs, but it’s worth it to prepare. Wishing you and your new kitty all the best!

What put you off pets best?

Hi Kimberly! Pets Best originally was on our list of the best providers, but it has since been replaced by other providers. We’re in the process of updating the review, though, and we may add it back after reviewing 2023 information.

I wish to delete the above comment since I have ruled out PetsBest insurance for my animals and am now leaning heavily toward Embrace.

Sorry for the confusion. The article makes reference to a website called “PetInsuranceReview.com” in the discussion about Lemonade Insurance. I took a look at this website and one person (Jeri Chen) has written over 100 (I stopped counting after I got to 100…) “10 star” reviews for Fetch and Trupanion (maybe others as well, but I stopped looking) which clearly skew the overall ranking for these (and other) companies. I have been struggling to find unbiased reviews of pet health insurance companies and was disappointed to find the clear bias in the review website that you referenced.

thank you for the leg work. this is important. i feel nothing is unbiased anymore.

I just looked at the “Pet Insurance Reviews” page you quote in this article. I noticed that the reviews for a couple companies (esp. Fetch) were top loaded with “10” rated reviews from the same person (Jeri Chen) that submitted what looked like over 100 “10” reviews. That finding does not give me much confidence in the info presented here.

Hi Deb, I’m not sure what you’re referring to. Can you clarify? Sorry about that—I looked through the article and still can’t quite figure out what you mean.

Surprised healthy paws was not on the list. Any reason why? Was originally going to move forward with them but now that

I see it wasn’t included in your list I’m concerned. Would love to know why it didn’t make the cut.

Thanks for the comment, Diana! Our picks are based on personal experience with the companies as well as customer comments. We use these comments to get a feel for how the company actually performs on the claims they make about their products. We weren’t able to find enough customer reviews to get a good feel for Healthy Paws versus the other insurance companies mentioned, but we can certainly take a second look in the future!

I don’t have much experience with pet insurance in general so what I’m about to say might apply to all insurance companies. My super senior cat has been a customer of Healthy Paws for about 4 years and every year they raise her policy despite never using it. What started out as ~$40/month is now ~$160/month. It’s difficult to find coverage for a senior pet, but it’s becoming unsustainable. I’ll be looking into Figo now thanks to this post.